How to verify car insurance is a crucial skill for navigating the modern motoring world. From rental cars to claims, accurate verification is key. This guide breaks down the process, covering online portals, phone calls, and essential documentation.

Understanding the nuances of verification is vital, whether you’re a seasoned driver or a newbie. This comprehensive guide provides a clear and concise pathway through the often-confusing maze of insurance verification.

Understanding Car Insurance Verification

Verifying car insurance is a crucial process for various stakeholders, ensuring the validity and accuracy of insurance coverage. This process acts as a safeguard against fraud and negligence, ultimately protecting the rights and interests of all parties involved. Its importance extends beyond simple compliance; it underpins trust and accountability in the insurance industry.Accurate verification is critical for maintaining a fair and efficient system, preventing fraudulent claims, and ensuring the responsible use of insurance benefits.

This process often requires the use of reliable and standardized verification methods to avoid discrepancies and maintain the integrity of the insurance system.

Purpose of Car Insurance Verification

Car insurance verification serves to authenticate the existence and validity of a car insurance policy. This process helps determine whether a policyholder is covered under a specific policy, preventing fraudulent claims and ensuring compliance with insurance regulations. Accurate verification is a crucial component of managing risk and minimizing financial losses for both the insurer and the policyholder.

Reasons for Verifying Car Insurance

Verification is necessary in numerous situations, ranging from routine checks to complex claims processes. The reasons for verifying car insurance are varied and often dictated by specific circumstances and legal requirements. This includes protecting the insurer from fraudulent activities, ensuring the safety of road users, and facilitating fair compensation in case of accidents.

Importance of Accurate Verification

Accurate car insurance verification is essential in various situations, including accident claims, rental car procedures, and legal proceedings. Inaccurate verification can lead to significant issues, from delayed compensation to legal repercussions. This process ensures the correct application of insurance policies, minimizes disputes, and promotes a fair and transparent system.

Consequences of Inaccurate or Fraudulent Verification

Inaccurate or fraudulent car insurance verification can have serious repercussions. This can result in denied claims, legal action, financial penalties, and damage to the individual’s reputation. The consequences can be far-reaching, affecting not only the individual but also the integrity of the insurance industry as a whole. For example, fraudulent claims can inflate insurance premiums for all policyholders.

Situations Requiring Insurance Verification

| Situation | Description | Importance |

|---|---|---|

| Rental Car | Verifying insurance is a prerequisite for renting a car. This is to protect the rental company from potential damages. | Ensures the rental company is adequately protected against potential losses from accidents. |

| Accident Claim | Insurance verification is crucial for processing accident claims. This verifies coverage and policy details. | Ensures the claimant receives appropriate compensation and the claim is processed correctly. |

| Legal Proceedings | Insurance verification is often required in legal cases involving car accidents or insurance disputes. | Provides critical evidence regarding coverage and policy details. |

| Driving Violations | Insurance verification is sometimes required in cases of driving violations to confirm the validity of coverage. | Assesses the driver’s compliance with insurance requirements and potentially determines penalties. |

| Insurance Audits | Insurance companies conduct audits to verify the accuracy of reported data and insurance policies. | Maintains the accuracy and integrity of insurance records, preventing fraud and ensuring fairness. |

Methods for Verifying Car Insurance

Verifying car insurance is crucial for various reasons, from ensuring a policyholder’s legal compliance to preventing fraudulent activities. Accurate verification processes are vital for all parties involved, ensuring the smooth operation of insurance transactions and maintaining public trust. This section details common methods used to verify car insurance policies, highlighting their procedures and inherent advantages and disadvantages.

Common Verification Methods

Various methods are employed to verify car insurance policies, each with its own set of strengths and weaknesses. These methods range from readily available online portals to more traditional phone-based verification systems. Choosing the most appropriate method depends on factors such as convenience, speed, and the specific requirements of the situation.

Online Portal Verification

Online portals provide a convenient and often instantaneous method for verifying insurance information. Policyholders can typically access their policy details through a secure website or mobile application. These portals often offer detailed policy information, including coverage amounts, dates of policy issuance, and the policyholder’s name.

- Procedures: Typically, policyholders log into their account, locate the policy in question, and access the relevant details. Verification often involves displaying specific information, such as policy number, effective dates, and driver’s details. The verification process may require confirmation through secure logins, which protects policy data from unauthorized access.

- Necessary Information: Policy number, login credentials, and the ability to access the online portal.

- Advantages: Rapid verification, readily available policy information, ease of use for policyholders, and often cost-effective for both parties.

- Disadvantages: Potential for technical issues, requiring internet access, and the need for the policyholder to have an online account and know the policy number.

Phone Call Verification, How to verify car insurance

Phone calls remain a viable method for verifying insurance policies, especially when online access is unavailable or when detailed information is required. Insurance companies typically have dedicated customer service lines for such inquiries.

- Procedures: Contacting the insurance company’s customer service department and providing details such as the policy number, driver’s name, and date of birth. An agent will then verify the policy’s existence and details.

- Necessary Information: Policy number, driver’s name, and other identifying information (date of birth, vehicle details, etc.).

- Advantages: Offers a direct line of communication, allows for detailed questions, and can be helpful for resolving ambiguities.

- Disadvantages: Can be time-consuming, may require waiting on hold, and the verification process relies on the accuracy and availability of the insurance company’s customer service representatives.

Verification Method Comparison

| Verification Method | Pros | Cons |

|---|---|---|

| Online Portal | Speed, convenience, detailed information readily available, cost-effective. | Requires internet access, technical issues possible, needs account and policy number. |

| Phone Call | Direct communication, detailed clarification possible, helpful for resolving ambiguities. | Time-consuming, potential for hold times, reliance on customer service representatives. |

Documentation and Information Needed for Verification

Accurate and complete documentation is crucial for verifying car insurance. Inaccurate or incomplete information can lead to delays or rejection of verification requests. Verification processes rely on the precise details provided, ensuring a smooth and efficient procedure.

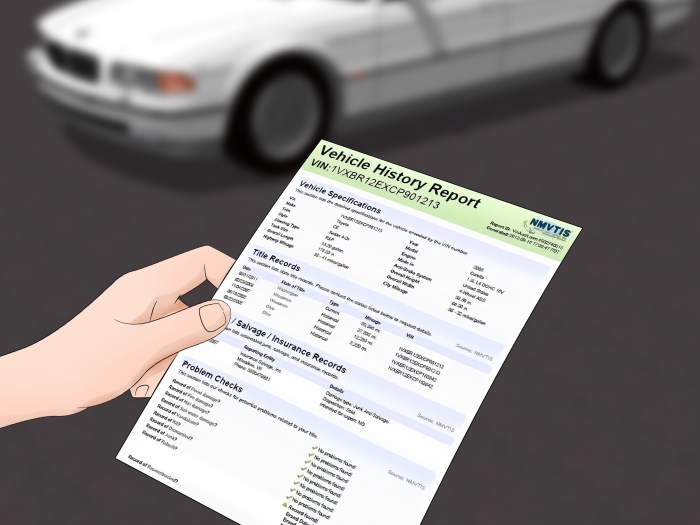

Required Documents for Car Insurance Verification

Verification of car insurance often requires specific documents to validate coverage. These documents provide the necessary proof of insurance policy and its terms. The specific requirements can vary based on the entity requesting the verification and the jurisdiction.

- Insurance Policy Document: This is the primary document, providing a comprehensive overview of the policy. The document should clearly Artikel the policyholder, vehicle(s) covered, policy effective dates, and coverage details. A sample policy document might include a section specifically listing insured vehicles, showing their identification numbers and details, such as VIN (Vehicle Identification Number).

- Proof of Payment: Evidence of premium payment is critical. This can be a recent bill or a statement showing the insurance policy is current. The payment confirmation should reflect the policy’s coverage period and the premium amount.

- Proof of Ownership: In many cases, verification requires evidence that the policyholder owns the vehicle. This might be a vehicle registration or title, indicating the registered owner and vehicle details. A title or registration document should include the vehicle’s identification number (VIN), the owner’s name, and other relevant information.

Format and Content of Insurance Documents

The format and content of insurance documents play a vital role in the verification process. Clear and legible documentation is essential. Insurance policies are typically detailed and structured to Artikel various aspects of the coverage.

- Policy Number: A unique identifier for the insurance policy, often crucial for locating the policy’s details. This is a key piece of information that allows for direct retrieval of the insurance policy’s details.

- Coverage Details: A comprehensive summary of the coverage provided, including liability limits, collision coverage, and other supplementary coverages. This section usually Artikels the terms and conditions, including any exclusions.

- Policyholder Information: The name, address, and contact information of the policyholder are important for identification purposes. Policyholders’ information should match the details provided in the request for verification.

Importance of Accurate and Complete Documentation

Accurate and complete documentation is paramount in insurance verification. Errors or omissions can delay or even invalidate the verification process.

- Efficiency: Accurate documents ensure the verification process is conducted quickly and efficiently.

- Validation: Accurate documents provide clear evidence of the policy’s existence and coverage.

- Accuracy: Precise documentation ensures that the verification process is not compromised by misinformation.

Information Contained Within Insurance Documents

Insurance documents contain a variety of crucial information, enabling the verification process.

| Document | Information Contained |

|---|---|

| Insurance Policy | Policy number, coverage details, policyholder information, effective dates, and insured vehicles |

| Proof of Payment | Payment date, amount, and confirmation of policy status |

| Proof of Ownership | Vehicle registration or title, vehicle identification number (VIN), owner’s name, and other relevant details |

Online Verification Processes

Online verification methods offer a convenient and efficient way to confirm car insurance coverage. This approach bypasses the need for physical documents, potentially saving time and effort. However, security and accuracy remain critical concerns. Users must carefully evaluate the platform’s security measures and verify the information presented.Online portals provide a streamlined process for verifying car insurance. They often incorporate robust security protocols, but users should remain vigilant and report any suspicious activity.

The availability of 24/7 access is a significant advantage, though the reliance on technology also presents potential vulnerabilities to system outages or technical glitches.

Steps for Verifying Car Insurance Online

Online verification typically involves accessing the insurer’s website, logging in, and reviewing policy details. This process varies based on the insurer and the specific online portal.

- Accessing the insurer’s website: Users navigate to the insurer’s official website, often through a dedicated insurance verification portal. This initial step requires correct URL entry to avoid fraudulent sites.

- Logging into the account: Successful account access often requires entering the policy number and other identifying information. Password management practices are crucial for protecting the account from unauthorized access.

- Reviewing policy details: Once logged in, users can access their policy details, including coverage amounts, dates of insurance, and insured vehicle information. This is where verification of accuracy is essential.

Examples of Online Verification Portals

Various insurance companies provide online portals for verifying coverage. These platforms are designed to be user-friendly and often provide detailed information about the policy.

- Insurer A: Provides a dedicated portal for policyholders to access and download documents, and includes a section to check policy status and coverage information.

- Insurer B: Offers an online portal that allows users to access a digital copy of their policy documents. Users can also view details about their claims history.

- Insurer C: Features a mobile app that simplifies access to policy details, coverage verification, and other policy-related information.

Interpreting Online Verification Information

Online portals display policy information in a structured format. Understanding this format is crucial for verifying accuracy. Pay close attention to the dates, amounts, and vehicle details.

- Coverage details: The online portal will display the details of the insurance coverage, including the amount of coverage for different aspects, such as liability, collision, and comprehensive.

- Policy period: The online portal will clearly state the start and end dates of the insurance policy. Users should ensure that the policy is active and valid during the period of their need.

- Vehicle details: The online portal will provide details about the insured vehicle, including the vehicle identification number (VIN), make, model, and year.

Step-by-Step Guide for Online Insurance Verification

This guide Artikels a straightforward process for verifying insurance online.

- Step 1: Open the insurance company’s website.

- Step 2: Locate the online verification portal or policy access section.

- Step 3: Enter the required login credentials, including policy number and password.

- Step 4: Review the policy details carefully.

- Step 5: Verify the accuracy of the information presented.

Comparison of Online Verification Platforms

A comparative analysis of online insurance verification platforms can be valuable.

| Platform | Features | Ease of Use | Security Measures |

|---|---|---|---|

| Insurer A | Comprehensive policy details, document downloads | Good | High |

| Insurer B | Claims history access, policy status updates | Excellent | Very High |

| Insurer C | Mobile app integration, quick access | Excellent | High |

Verification by Phone or Mail

Verification via phone or mail presents distinct advantages and disadvantages compared to online methods. While online methods offer convenience and speed, phone and mail-based verification can provide a more personal touch and potentially offer a higher degree of security, especially for sensitive information. However, these methods are generally slower than online verification.

Phone Verification Process

Phone verification relies on direct communication with the insurance provider. This method allows for clarification of details and ensures the accuracy of the information exchanged. An effective phone verification process requires a structured approach.

- Initiating the call involves identifying the caller’s purpose clearly. The caller should state their intention to verify insurance coverage for a specific vehicle and provide the necessary identification information. This establishes the context of the call and ensures the correct information is obtained.

- Providing the necessary information is critical. The caller must be prepared to furnish the vehicle’s details (make, model, year, VIN), policyholder’s name, and policy number. This information allows the insurance provider to access the relevant records.

- Clarifying details is essential for accuracy. The insurance representative may ask for additional details to confirm the policy and ensure its validity. This might include the policyholder’s address, date of birth, or other identifiers.

- Confirming the verification is the final step. The insurance representative will confirm the details and provide a confirmation, possibly in writing or via a recorded message. This ensures a record of the verification process.

Mail Verification Process

Verification by mail requires a formal request, often accompanied by specific documentation. The process is typically slower than phone verification.

- Formulating a request involves drafting a formal letter requesting the verification of insurance coverage. The letter should clearly state the purpose of the request, including the vehicle’s details, policyholder’s information, and the policy number. A pre-addressed, stamped envelope for the response is crucial for efficiency.

- Providing supporting documentation is essential. The letter should include copies of relevant documents, such as the vehicle registration, the policyholder’s identification, and the insurance policy details.

- Waiting for the response is an inherent part of the mail verification process. The response time can vary depending on the insurance company’s procedures and workload.

- Reviewing the response is critical to ensuring the accuracy of the verification. The response should contain the verification confirmation and potentially a statement about the validity of the insurance policy.

Communication Protocol

Effective communication is key in both phone and mail verification. Clear and concise language should be used, avoiding ambiguity. Professionalism is paramount.

“Please state your name, policy number, and vehicle identification number (VIN).”

Figuring out if your car insurance is legit? Check policy documents, look for a verifiable insurance ID number, and double-check with the insurer directly. For a totally different kind of verification, if you’re considering a nose job, finding the best rhinoplasty surgeon in Atlanta, like this one , might be your next big decision. But, back to insurance, always make sure the paperwork matches the coverage you’re paying for.

Expected Response Times

Response times vary considerably depending on the method and the insurance company. Phone verification can be relatively quicker, while mail verification typically takes several business days.

Language and Tone Examples

- Phone: “Thank you for calling. My name is [Representative Name]. I’m verifying your insurance policy. Could you please provide the policy number?”

- Mail: “Dear [Insurance Company], I am writing to request verification of insurance coverage for [Vehicle Details]. Please find attached copies of the required documents.”

Comparison Table

| Feature | Phone Verification | Mail Verification |

|---|---|---|

| Speed | Generally faster | Generally slower |

| Cost | Potentially higher due to call charges | Potentially lower |

| Accuracy | Higher chance of immediate clarification | Potential for misinterpretation or delays |

| Documentation | Less extensive | More extensive |

| Convenience | More convenient | Less convenient |

Issues and Challenges in Verification

Verifying car insurance can encounter various obstacles, from simple administrative errors to more complex systemic issues. Understanding these potential problems is crucial for a smooth verification process, minimizing delays and ensuring accurate information. Effective strategies to resolve these issues are vital to maintain the integrity of the verification process.

Common Problems Encountered

Numerous issues can arise during car insurance verification. These often stem from errors in paperwork, outdated information, or problems with the insurance provider’s systems. Inaccurate or incomplete data within the insurance company’s database can lead to verification failures. Furthermore, communication breakdowns between the verifier and the insurance company can impede the process.

Potential Reasons for Verification Failures

Verification failures frequently stem from discrepancies in the information provided. Incorrect policy numbers, dates of coverage, or driver names can all lead to verification failures. The insurance provider’s internal systems may also experience glitches or be temporarily unavailable, causing delays or rejection of the verification request. Outdated or incomplete information in the verifier’s records, like the vehicle’s registration details, can also cause verification problems.

A lack of clear communication channels or a misunderstanding of the verification process can also be factors.

Resolving Issues During the Verification Process

To address verification issues effectively, several strategies can be employed. Contacting the insurance company directly for clarification or updated information is a critical first step. Providing additional documentation, like a copy of the insurance policy or a recent payment receipt, can often resolve discrepancies. Following up with the insurance company to ensure your request is processed promptly and accurately can resolve issues.

Examples of Errors or Discrepancies

Numerous errors can cause verification issues. A common mistake is using an incorrect policy number, which may result in a verification failure. Another example involves submitting an outdated policy, which the insurance company may not recognize as valid. Incorrect vehicle identification numbers (VIN) or discrepancies in the driver’s name can also lead to verification failures.

Steps to Take if a Verification Request is Rejected

If a verification request is rejected, it’s important to identify the reason for rejection. Review the rejection notice carefully for specific instructions or suggested actions. Contact the insurance company to understand the nature of the issue and request clarification. If necessary, submit updated or corrected documentation to rectify the problem. If the issue persists, seek assistance from a customer service representative or consult with legal professionals, as necessary.

Strategies to Overcome Verification Challenges

Effective strategies for overcoming verification challenges include double-checking all submitted information for accuracy. Thoroughly verifying all details, including policy numbers, dates, and driver names, is crucial. Maintaining clear communication channels with the insurance company throughout the verification process can help address issues proactively. Having readily available supporting documents, like the policy declaration page or proof of payment, can expedite the process and help resolve any potential discrepancies.

Illustrative Scenarios and Examples

Verifying car insurance is a crucial process across various contexts, from simple rentals to complex claims and legal proceedings. This section provides illustrative scenarios to demonstrate the practical application of verification methods in different situations, highlighting the importance of accurate documentation and procedures.

Verifying Insurance for a Rental Car

Rental car companies require proof of insurance to mitigate risk. The verification process typically involves examining the renter’s insurance policy documents. These documents must include the renter’s name, policy number, coverage details, and the rental period. The rental company will likely compare this information against the insurer’s records to confirm the validity of the coverage. Failure to provide or verify insurance can result in additional fees or even denial of the rental.

Rental agreements often specify penalties for lacking valid insurance.

Verifying Insurance for an Accident Claim

Insurance verification is critical during accident claims. The insurance company of the at-fault party or the party filing a claim needs to verify the policy details, including coverage limits, policy number, and the insured’s name. The verification process helps determine the amount of compensation payable and ensures that the claim is processed according to the terms of the insurance policy.

Figuring out if your car insurance is legit? It’s a total game-changer, especially when you’re trying to navigate the housing market. Checking your policy details online is a great start, but digging deeper into recent reviews of Winslow Apartments San Diego, like winslow apartments san diego reviews , might give you some clues. You’ll find out if other tenants are having similar insurance-related issues.

Then, you can confidently verify your car insurance coverage, and know that you’re totally protected.

Documentation like the police report, the accident report, and the insurance policy are all crucial to determining liability and calculating damages.

Verifying Insurance for a Car Sale

When selling a car, verifying the buyer’s insurance is essential to protect the seller from potential liabilities. The seller should require the buyer to present their insurance policy details, including the policy number, coverage, and the date of commencement of coverage. This helps ensure that the buyer has adequate insurance to cover potential damages or accidents involving the vehicle.

A copy of the policy or proof of insurance may be sufficient, as long as the policy information is clearly displayed. The verification process should also verify the validity of the policy during the sale transaction.

Verifying Insurance for Obtaining a Driver’s License

Insurance verification for obtaining a driver’s license is part of the licensing process in some jurisdictions. This verification ensures that the applicant has adequate liability insurance coverage, which is a requirement to obtain or maintain a valid driver’s license. Applicants must provide proof of insurance to the licensing authorities. The authorities will verify the insurance information against the insurer’s records.

The required proof can vary by jurisdiction.

Verifying Insurance for Renewing Insurance

Renewing car insurance involves verifying the policy details. The insured must provide proof of insurance coverage to the insurer. The insurer will verify the applicant’s details and any changes in the policy. This verification process ensures that the insured remains compliant with the required insurance coverage. Verification processes may vary slightly based on the specific insurer’s procedures.

Verifying Insurance for an Insurance Fraud Investigation

Insurance fraud investigations require rigorous verification of insurance policies. Investigators must scrutinize the claim details, policy documents, and potentially conduct background checks. Investigators might examine inconsistencies in statements, dates, or policy information. The verification process aims to identify fraudulent activities and hold individuals accountable for their actions. Investigative agencies may use sophisticated methods to verify insurance policies and detect fraud.

Concluding Remarks: How To Verify Car Insurance

In conclusion, verifying car insurance is a straightforward process when approached methodically. By understanding the various methods, necessary documentation, and potential issues, you can confidently navigate the verification process. This guide equips you with the knowledge to handle any scenario, from rental car procedures to insurance fraud investigations.

Commonly Asked Questions

What documents are typically required for verifying car insurance?

The required documents vary, but commonly include your insurance policy document, proof of coverage, and your driver’s license. Always check with the specific party requesting the verification.

What are some common problems encountered during car insurance verification?

Common issues include incorrect or outdated information, missing documents, or issues with the verification portal itself. If there are problems, follow the instructions provided for resolving them.

How long does the verification process usually take?

Verification times vary depending on the method used. Online portals are usually instantaneous, while phone or mail requests might take a few business days.

What if my verification request is rejected?

If your request is rejected, review the reason for the rejection. If there’s an error, rectify it and resubmit the request. If the issue isn’t easily fixed, contact the insurance company or relevant party for assistance.