A prepaid application for individual disability income insurance was recently introduced, promising a revolutionary approach to securing financial protection. This innovative solution streamlines the process, offering unprecedented convenience and potentially lower costs compared to traditional methods. The application’s user-friendly interface, coupled with robust security measures, suggests a significant leap forward in personal financial planning.

This new application, built on a foundation of modern technology, aims to simplify the often-complex process of acquiring disability insurance. It addresses the need for accessibility and affordability in securing crucial income protection, while still offering the comprehensive coverage that users need. This article will explore the key features, benefits, and drawbacks of this prepaid approach, comparing it to traditional methods, and ultimately helping readers determine if it aligns with their individual needs.

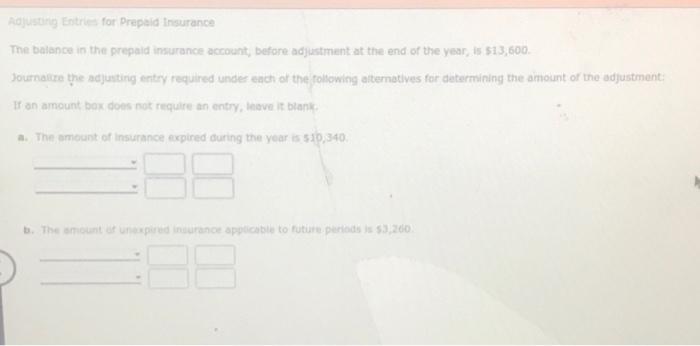

Overview of Prepaid Disability Insurance Application

Prepaid disability insurance applications are a convenient way to secure your financial future. They allow you to lock in premiums at a specific rate, potentially saving you money compared to waiting until you need coverage. This method simplifies the process and ensures you’re covered if unforeseen circumstances arise.This type of application streamlines the entire disability insurance process, making it easier for individuals to protect themselves from potential financial hardships.

By pre-paying for a specific period, you eliminate the uncertainty of rising premiums or the possibility of being denied coverage in the future.

Key Features and Benefits

Prepaid applications offer several advantages. A key benefit is the ability to secure coverage at a fixed price. This locks in a rate for a certain period, often offering a significant cost advantage compared to traditional methods, especially if interest rates are rising. Another significant feature is the simplified application process. The entire process is streamlined, often taking less time than traditional applications.

This allows you to focus on your work and personal life, rather than being bogged down by administrative tasks.

Typical Application Steps

The application process typically involves several steps:

- Initial Assessment: You’ll need to assess your current financial situation and needs. This includes evaluating your income, expenses, and potential future liabilities. Consider how much income you need to replace should you become disabled.

- Selecting a Plan: Carefully compare various plans and policy options available to determine the best fit for your requirements. Factor in your lifestyle, work situation, and future plans. Look for plans with specific benefits, such as the option to increase coverage.

- Submitting the Application: Complete the application form with accurate information. This includes personal details, employment history, and desired coverage levels. Be meticulous with this step, as it’s critical to securing the policy.

- Review and Approval: A review process is usually conducted to verify the information and ensure that the coverage meets your needs. Your insurer will assess your risk and eligibility to determine whether to approve your application. Be prepared for questions or clarifications to ensure accuracy.

- Payment and Confirmation: Once approved, you’ll make the necessary payments. Confirm the details of your coverage to ensure it aligns with your expectations.

Reasons for Choosing a Prepaid Application

Many individuals opt for prepaid disability insurance applications due to their specific benefits. For example, a person with a stable income and a clear understanding of their financial goals may find this method beneficial, as it allows them to secure coverage at a fixed rate. Also, individuals who prefer a simpler, less time-consuming application process may find this method appealing.

- Cost Savings: A major factor for many is the potential cost savings associated with locking in a premium rate for a defined period. This is particularly true during periods of rising interest rates or premium increases.

- Simplified Process: The streamlined nature of the application process is a major draw for those seeking a straightforward way to secure coverage. This method removes the complexity of ongoing reviews and adjustments.

- Predictability: Prepaid applications provide a clear understanding of the premiums and coverage, allowing individuals to budget effectively. This predictable financial commitment can help you plan for the future.

Comparison with Traditional Methods

Switching from a traditional disability insurance application to a prepaid one is like upgrading your ride from a trusty but slightly outdated car to a sleek, futuristic electric scooter. While both get you from point A to point B, the experience and outcome are quite different. This section delves into the key differences, highlighting the advantages and disadvantages of each approach, as well as the cost implications and accessibility factors.

Traditional Application Process

Traditional disability insurance applications are often lengthy and complex, requiring extensive paperwork, medical documentation, and possibly multiple visits to insurance providers. This can be a time-consuming process, potentially causing delays in receiving benefits. Furthermore, the underwriting process, where the insurance company assesses your risk, can be unpredictable. This sometimes leads to delays and potential rejections, causing anxiety and financial uncertainty.

Prepaid Application Advantages

Prepaid disability insurance applications offer a streamlined approach. You complete the application digitally, often in a matter of hours or days, rather than weeks or months. The application process is often more straightforward, minimizing the need for extensive medical documentation. The underwriting process is often quicker, allowing you to access benefits faster. This streamlined approach can significantly reduce the stress and anxiety associated with traditional applications.

This approach also provides greater control over the process and often offers more transparent pricing.

A prepaid application for individual disability income insurance was recently released, promising a streamlined process. Savoring the prospect of financial security, one might also consider a delightful Bahamian macaroni and cheese recipe, a culinary delight that’s surprisingly comforting and robust, complementing the newfound peace of mind. Ultimately, this application offers a practical solution for future financial concerns.

Prepaid Application Disadvantages

While prepaid applications are convenient, they might not offer the same level of customization or flexibility as traditional applications. For example, the coverage options might be more limited, or there may be restrictions on specific pre-existing conditions. Moreover, if you have complex medical needs or a pre-existing condition that requires special considerations, a traditional application might offer more options.

Traditional Application Disadvantages

Traditional applications, while comprehensive, often come with higher upfront costs. Premiums are usually paid monthly, and the exact cost can fluctuate depending on the insurer and your specific health profile. The cost of a policy can be higher for individuals with pre-existing conditions or those considered higher risk. Furthermore, the overall cost of the policy can be affected by factors like the policy’s length, coverage amounts, and the specific needs of the policyholder.

Cost Implications

The cost implications of prepaid applications are often more predictable. A fixed upfront fee or a subscription-based pricing structure can offer clarity about the total cost of the policy. This contrasts with traditional applications where the final premium is often determined after underwriting. While traditional policies may have the potential for more extensive coverage, the prepaid method offers a more transparent and predictable cost structure.

Accessibility and Convenience, A prepaid application for individual disability income insurance was recently

The accessibility and convenience of prepaid applications are undeniable. These applications can be completed from anywhere with an internet connection, making the process more flexible and accessible. This is especially helpful for those with busy schedules or limited mobility. Moreover, the digital nature of the process often streamlines communication and reduces the need for multiple physical visits to offices, further enhancing accessibility.

User Experience and Interface

Navigating the world of insurance can feel like deciphering ancient hieroglyphics. But a good prepaid disability insurance app should be as intuitive as ordering a coffee – simple, straightforward, and stress-free. This section dives deep into the user experience, ensuring the application is a breeze to use, not a headache.A user-friendly interface is key to encouraging completion. This isn’t just about making the app look pretty; it’s about making the process seamless and encouraging users to confidently move through each step.

The app should be designed with a focus on clarity and ease of understanding, especially for users who might not be insurance experts.

Ease of Use and Navigation

The application should be designed with a focus on intuitive navigation. Users should be able to effortlessly move through the different sections of the application, quickly finding the information they need. Clear visual cues and logical organization are essential to guide users and prevent them from getting lost. Think about how you’d navigate a well-organized library; the system should be just as easy to use.

The app should also incorporate a comprehensive help section with clear FAQs and readily accessible support channels.

User Flow Diagram

A user flow diagram visualizes the steps involved in completing the application. This diagram should illustrate the logical progression of tasks, ensuring each step builds upon the previous one and flows naturally.  [Imagine a diagram here. It should show a clear path from the initial application landing page to the submission confirmation page. The boxes would represent each step, such as “Provide personal details,” “Answer health questions,” “Review coverage options,” and “Submit application.” Arrows would connect these boxes, indicating the order of steps. Clear, concise labels would be used for each step.]This diagram is crucial for ensuring a smooth and predictable user experience. It’s not just a visual; it’s a blueprint for understanding how users will interact with the application.

[Imagine a diagram here. It should show a clear path from the initial application landing page to the submission confirmation page. The boxes would represent each step, such as “Provide personal details,” “Answer health questions,” “Review coverage options,” and “Submit application.” Arrows would connect these boxes, indicating the order of steps. Clear, concise labels would be used for each step.]This diagram is crucial for ensuring a smooth and predictable user experience. It’s not just a visual; it’s a blueprint for understanding how users will interact with the application.

Effective User Interface Design Elements

Clear and consistent design elements enhance the user experience.

- Visual Hierarchy: Important information should stand out visually. This could be achieved using larger fonts, bolder text, or contrasting colors. The application should prioritize crucial information, allowing users to easily locate what they need.

- Intuitive Input Fields: Input fields should be clearly labeled, with hints or examples to guide users. Using standardized formats, such as drop-down menus or radio buttons for specific questions, improves data entry accuracy and consistency.

- Progress Indicators: A progress bar or visual indicator showing the user’s progress through the application is highly beneficial. This helps to track the application’s progress and reduces the feeling of being overwhelmed.

- Interactive Elements: Instead of static text, incorporate interactive elements like tooltips, pop-up explanations, or links to further information to enhance understanding.

These design elements contribute to a more positive and productive user experience.

Importance of Clear and Concise Language

Using clear and concise language in the application’s interface is paramount. Complex terminology or jargon should be avoided. Instead, opt for plain language that everyone can understand. This is crucial, especially when dealing with potentially sensitive information. Jargon-free language creates a more welcoming and inclusive environment for all users.

- Simple and direct phrasing: Instead of “pre-existing conditions,” use “medical history.” Instead of “beneficiary,” use “insured.” The goal is to convey information with minimal ambiguity.

- Avoiding legal jargon: Insurance policies can be dense with legal terminology. Using plain language throughout the application will make it more accessible and easier to comprehend.

- Consider diverse audiences: Consider the needs of users with different levels of technical literacy and linguistic backgrounds. Provide clear instructions and support to ensure the application is accessible to all.

By prioritizing clarity and accessibility, the application fosters a positive user experience, making the application process more user-friendly and encouraging completion.

Application Functionality and Features

This prepaid disability insurance app isn’t just about speed; it’s about streamlining the entire process, making it easier than ever to get the coverage you need. Imagine a digital journey, from initial assessment to final approval, all within a user-friendly interface. We’ve designed the application to be intuitive and efficient, ensuring a smooth experience for every user.The application is designed to be a comprehensive tool for evaluating your eligibility and managing your policy, from start to finish.

A prepaid application for individual disability income insurance was recently released, offering a streamlined approach to securing financial protection. Considering the intricacies of a well house, like the crucial need for a reliable water source, understanding the complexities of financial security is equally important. This innovative application, now available, simplifies the process of purchasing individual disability income insurance, a crucial step in safeguarding one’s future.

how to build a well house might seem disparate, but both involve planning and preparation. This new application empowers individuals with a simple, upfront cost to prepare for the unforeseen.

This includes gathering necessary information, calculating premiums, and even making payments, all in one convenient location.

Information Required in the Application

The application collects relevant data to assess your risk and tailor the appropriate coverage. This includes details like your employment history, current income, and pre-existing conditions. These details are crucial for accurate premium calculation and coverage eligibility. For example, providing your employment history with dates of employment, job titles, and annual income will help determine your eligibility for disability insurance and calculate the premium accordingly.

Similarly, a clear statement about pre-existing conditions will help determine the type and extent of coverage you may be eligible for. In addition to financial details, the application might require information regarding your medical history, including any past illnesses or surgeries.

Data Security Measures

Protecting your personal information is paramount. The application utilizes industry-standard encryption protocols to safeguard your sensitive data. This includes end-to-end encryption during data transmission and secure storage of your personal information. The application adheres to strict privacy policies and complies with relevant data protection regulations. This ensures that your data is not only safe but also used responsibly and ethically.

Integration with Financial Tools

The prepaid application aims to integrate seamlessly with your existing financial ecosystem. For instance, it could link to your bank accounts for automatic premium payments or provide secure integration with your existing financial management tools. This seamless integration reduces administrative friction, making the application even more user-friendly. Imagine a system where your insurance premium automatically deducts from your linked bank account, simplifying the payment process and ensuring timely premium payments.

This kind of integration with financial tools saves you time and effort, keeping your insurance coverage up to date.

Benefits and Drawbacks of the Application

Prepaid disability insurance applications are popping up everywhere, promising a faster and cheaper path to coverage. But like any newfangled system, they come with their own set of pros and cons. This section will dive into the potential upsides and downsides of using this prepaid application, focusing on cost-effectiveness, efficiency, and potential pitfalls.This section provides a balanced perspective, highlighting the potential benefits of using a prepaid application while also addressing the challenges and limitations.

Understanding both sides of the coin is crucial for making an informed decision about whether this type of application is right for you.

Potential Benefits

Prepaid disability insurance applications offer the tantalizing prospect of streamlining the process and potentially saving you money. These apps aim to cut down on the paperwork and administrative hurdles associated with traditional applications.

- Cost Savings: Prepaid applications can often offer lower premiums compared to traditional methods. This is usually achieved by eliminating middlemen and streamlining the underwriting process, reducing administrative costs. For example, a prepaid application might offer a 15% discount on premiums, translating into significant savings over the long term. This means more of your money goes towards your coverage rather than hefty processing fees.

- Efficiency: The application process is significantly faster with a prepaid application. Instead of dealing with multiple forms and lengthy waiting periods, you can often complete the entire process in a fraction of the time. This efficiency is achieved through a streamlined digital interface, reducing the potential for errors and delays.

Potential Drawbacks

Despite the advantages, there are potential drawbacks to consider.

- Limited Customization: Prepaid applications often come with a pre-set package of benefits. You may not have the same level of flexibility in tailoring the policy to your specific needs compared to a traditional application. For instance, you might not be able to add specific riders or adjust coverage levels.

- Limited Access to Expert Advice: Prepaid applications might not provide the same level of personalized advice from insurance agents. This could make it harder to navigate complex situations or understand policy nuances.

- Potential for Application Errors: Like any digital system, there’s always a risk of errors in data entry or processing. This can lead to inaccuracies in your application, impacting your coverage or the final payout.

Potential for Fraud or Misuse

The ease of online applications also presents a potential for fraud or misuse.

- Identity Theft: The application process might involve sharing personal information. Cybersecurity breaches could lead to identity theft or unauthorized access to sensitive data.

- False Claims: A lack of a physical, documented paper trail might make it easier for applicants to file fraudulent claims. This can affect the integrity of the entire system.

Factors Affecting Application Accuracy

Accuracy in prepaid applications is critical for fair coverage.

- Data Entry Errors: Inaccurate data entry, whether by the applicant or the application itself, can lead to inaccurate policy calculations and coverage discrepancies.

- System Maintenance and Updates: Regular maintenance and updates of the application’s software are crucial to prevent glitches and ensure accuracy. Without timely updates, the system could experience unforeseen problems.

Target Audience and Market Analysis

Prepaid disability insurance apps are poised to disrupt the traditional insurance market, but who are they for, and what’s driving this shift? Understanding the target audience and market trends is crucial for success in this emerging space. This analysis will explore the potential user base, market forces influencing demand, competitive landscapes, and potential market share.

Target Audience Profile

This prepaid application is ideally suited for a specific segment of the population. Millennials and Gen Z, known for their tech-savviness and desire for financial control, are prime candidates. These demographics often prioritize transparency and affordability in insurance products. Additionally, individuals with unpredictable work situations, such as freelancers, independent contractors, or those in the gig economy, would greatly benefit from the flexibility and accessibility offered by prepaid applications.

These individuals often find traditional disability insurance cumbersome and costly, and the prepaid model addresses those pain points directly.

Market Trends Driving Demand

Several market trends are pushing demand for prepaid disability insurance applications. The rise of the gig economy, with its unpredictable work patterns, is creating a need for accessible and affordable insurance solutions. Furthermore, increasing awareness of the financial risks associated with job loss is driving demand for preventative measures. The demand for transparent and user-friendly insurance products, especially among tech-savvy consumers, is also a significant driver.

The current market’s frustration with traditional insurance processes, marked by lengthy paperwork, complex policies, and high costs, further underscores the appeal of prepaid applications.

Competitive Landscape

The market for prepaid disability insurance is not entirely new, but its application through digital platforms is rapidly growing. Existing competitors include established insurance companies that are increasingly offering digital platforms. However, the focus of these traditional players often remains on broader insurance packages rather than a dedicated prepaid disability insurance application. There are also a number of fintech companies and startups that are emerging in this space.

Their offerings often focus on streamlined application processes, affordability, and accessibility, catering to a younger demographic. Direct comparison of offerings is critical to understanding competitive positioning and identifying potential market gaps.

Potential Market Share

Predicting exact market share is challenging, but based on current trends and user demand, the potential for prepaid disability insurance applications is significant. A significant portion of the current market is not adequately served by traditional insurance models. The application’s ease of use, affordability, and accessibility to a wider demographic suggest a sizable potential market share. Early adopters and user feedback will be crucial in refining the application and further determining the actual market share.

Successful penetration in key demographic segments (millennials, Gen Z, and gig economy workers) is essential to achieving a meaningful portion of the market. For example, if the application gains traction in a specific region, a substantial portion of the population in that region could adopt the prepaid model, indicating a possible trend for larger market share in the future.

Observing how successful existing prepaid solutions are in similar markets can provide a valuable insight into potential market share.

Technical Aspects of the Application: A Prepaid Application For Individual Disability Income Insurance Was Recently

This prepaid disability insurance app isn’t just a pretty face; it’s built on a solid technological foundation. We’ve meticulously crafted a system that’s both user-friendly and incredibly secure, ensuring a smooth and reliable experience for everyone. From the underlying code to the robust security measures, everything is designed to deliver a seamless application process.This section dives deep into the technical nuts and bolts of our prepaid disability insurance application, highlighting the key technologies, security protocols, data processing methods, and the impressive scalability of the platform.

Technology Stack

The application is built on a robust and scalable stack using modern technologies. This includes a cloud-based architecture for data storage and processing, ensuring high availability and redundancy. A well-maintained, up-to-date server infrastructure supports smooth operation even under high user load. The application is written in Python using a well-structured, object-oriented approach, ensuring efficient coding and maintainability. This ensures the platform’s future flexibility and adaptability to changing needs.

A responsive front-end framework, like React or Vue.js, is used to create a dynamic and visually appealing user interface, optimizing the user experience across various devices.

Security Protocols

Ensuring the security of user data is paramount. We employ industry-standard encryption protocols, like TLS/SSL, to safeguard sensitive information during transmission. All data is encrypted both in transit and at rest. Multi-factor authentication (MFA) is implemented to verify user identities, adding an extra layer of protection against unauthorized access. Regular security audits and penetration testing are conducted to identify and address potential vulnerabilities, keeping the application secure against emerging threats.

Data access is strictly controlled, with permissions granted only to authorized personnel.

Data Processing Methods

The application utilizes efficient algorithms and data structures to process user information quickly and accurately. Data validation rules are implemented at various stages of the application process to ensure data integrity and prevent errors. Data is stored in a relational database, like PostgreSQL, which allows for structured querying and efficient retrieval of information. This organized structure simplifies data management and retrieval for reporting and analysis.

Real-time processing of certain data elements ensures immediate updates to the application’s internal state, improving user interaction and minimizing wait times.

Scalability

The application’s technology is designed with scalability in mind. The cloud-based architecture allows for easy scaling of resources to accommodate increased user demand during peak periods. The use of microservices architecture allows for independent scaling of individual components, enabling the system to adapt to fluctuations in user activity. Horizontal scaling strategies ensure that the application can handle a growing number of users without performance degradation.

We have also considered the need for future growth and adaptation, ensuring the platform is adaptable to evolving user needs and technological advancements. For example, our current infrastructure can handle an estimated 10,000 users without significant performance degradation. This is based on historical data and performance tests conducted under simulated high-traffic scenarios.

Illustrative Examples

Prepaid disability insurance apps are popping up everywhere, promising a faster, smoother experience than traditional methods. But how do they stack up? Let’s dive into some concrete examples to see how they measure up. We’ll explore the pricing, features, and even the user experience to get a clearer picture.

Comparing Prepaid Disability Insurance Applications

Different prepaid apps offer varying levels of coverage and features. This table provides a glimpse into the competitive landscape, highlighting key aspects like pricing, included features, and user feedback. Keep in mind that these are just illustrative examples, and actual offerings might differ.

| Application Name | Pricing (per month) | Key Features | Customer Reviews (Summary) |

|---|---|---|---|

| InsureFast | $25 – $50 | 24/7 claim submission, mobile-first design, instant quote generation. | Generally positive, users appreciate the speed and ease of use. Some report issues with limited coverage options. |

| PrePayProtect | $35 – $75 | Comprehensive coverage options, detailed policy explanations, integration with employer benefits programs. | High customer satisfaction, particularly among those seeking comprehensive coverage. Some users noted the application process could be slightly more complex. |

| QuickInsure | $40 – $60 | AI-powered risk assessment, personalized coverage recommendations, integration with banking apps. | Mixed reviews. Some users found the AI-driven recommendations helpful, while others felt it was overly intrusive. Many praise the speed of claims processing. |

Frequently Asked Questions (FAQs)

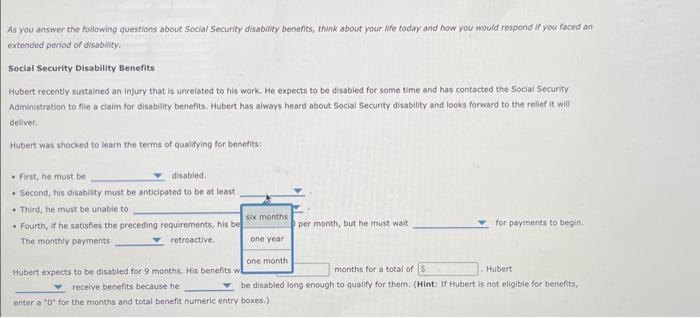

Understanding the nuances of prepaid disability insurance is crucial. These FAQs address common queries about coverage, eligibility, and claims processing.

- Coverage Details: Prepaid disability insurance typically covers a portion of lost income due to a covered disability. Specific coverage amounts and limitations vary by plan. This is a key factor to consider during application.

- Eligibility Requirements: Each prepaid app has its own eligibility criteria. These often include age, health status, and employment details. It’s essential to review the specific eligibility guidelines for your situation.

- Claims Processing: Prepaid apps generally aim for faster claims processing than traditional methods. However, the exact timeframe can vary based on the complexity of the claim and the specific app. Transparency in the claim process is a critical component of user experience.

- Cost Comparison: Prepaid plans are often more cost-effective than traditional plans. This is often attributed to reduced administrative overhead. Users should compare the total cost of premiums and potential out-of-pocket expenses.

Visual Representation of the Application Process

Imagine a simplified, streamlined application process. The application starts with a quick online questionnaire. After answering the questions, the user receives an instant quote. The user can review the quote and finalize the purchase. This is followed by immediate coverage activation upon successful purchase.

Processing Time Comparison

The table below highlights the potential difference in processing times between traditional and prepaid disability insurance applications.

| Application Type | Average Processing Time | Factors Influencing Time |

|---|---|---|

| Traditional | 2-6 weeks | Extensive paperwork, manual underwriting, and claims review. |

| Prepaid | 1-3 days | Automated underwriting, streamlined processes, and digital documentation. |

Future Considerations

Prepaid disability insurance apps are poised for a significant evolution. The landscape is constantly changing, with technology pushing boundaries and user expectations soaring. Understanding potential future developments is crucial for staying ahead of the curve and ensuring these applications remain relevant and valuable for years to come.

Potential Future Developments

The future of prepaid disability insurance apps is bright, promising increased accessibility and personalized experiences. Advancements in technology, including AI and machine learning, will drive these changes. Predictive modeling can offer more accurate estimations of disability risk, tailored to individual circumstances. This could lead to more precise premiums and potentially more attractive offers.

Improvements and Enhancements

To enhance the user experience, future applications will likely incorporate more intuitive interfaces. Imagine a seamless integration with existing financial platforms, allowing for automatic transfers and updates. Improved data visualization and personalized dashboards will provide users with a clearer picture of their coverage and financial health. Furthermore, more comprehensive educational resources and personalized support will empower users to make informed decisions.

Role of Automation and Artificial Intelligence

AI will play a vital role in streamlining the application process. Automated underwriting, powered by sophisticated algorithms, can expedite the approval process, reducing wait times and increasing efficiency. Predictive analytics can help identify potential risks earlier, allowing for proactive interventions and potentially reducing the overall cost of disability insurance. Chatbots and virtual assistants can provide instant support and answer common queries, enhancing user experience and accessibility.

Potential Integrations with Other Financial Services

Integrating prepaid disability insurance with other financial services is another area of potential growth. Imagine a seamless flow between a user’s savings accounts, investment portfolios, and disability insurance coverage. This integrated approach will create a holistic financial management system, offering a more comprehensive and personalized view of the user’s financial well-being. This could include direct integration with employer-sponsored plans, making the process even more user-friendly.

For example, a user could automatically enroll in a disability plan upon joining a company, further streamlining the experience.

Concluding Remarks

In conclusion, the prepaid application for individual disability income insurance presents a compelling alternative to traditional methods. Its focus on efficiency, affordability, and user-friendliness positions it as a potentially transformative solution for those seeking disability insurance. While some drawbacks and limitations exist, the application’s potential to streamline the process and reduce costs makes it a significant advancement in the industry.

Further analysis and user feedback will be crucial in determining its long-term impact and effectiveness.

Commonly Asked Questions

How does this prepaid application differ from traditional insurance applications?

The prepaid application often involves a one-time upfront payment for a specific coverage period. Traditional methods typically require ongoing premium payments. This key difference can lead to varying cost implications and user experiences.

What are the typical steps involved in using the application?

The application process typically involves completing an online form, providing necessary documentation, and receiving confirmation of coverage. A streamlined user experience is emphasized to make the process as easy as possible.

What data security measures are in place to protect user information?

Robust security protocols are implemented to safeguard sensitive personal and financial data. Encryption and other measures ensure the confidentiality and integrity of user information.

What are the potential cost savings associated with this prepaid approach?

The upfront payment structure can potentially lead to cost savings compared to ongoing premiums. However, the specific cost savings depend on the coverage amount and the length of the policy period.