Is the medicare spending card legit? Navigating the murky waters of healthcare costs can leave you feeling like you’re in a maze. This ain’t your average spending card, though. It’s a potential lifeline, but you need to know if it’s legit or a scam. We’ll dissect the ins and outs, from potential benefits to the pitfalls.

Understanding the specifics of these cards, their purported advantages, and the potential risks is key. We’ll cover various aspects, from how they function to comparing them with other healthcare assistance options. Expect a deep dive into their potential use cases, alongside examples of how they could benefit or hinder your situation. The bottom line is: are they a game-changer, or just a load of old rubbish?

Understanding Medicare Spending Cards: Is The Medicare Spending Card Legit

Medicare spending cards, if they exist, are not a standard or recognized feature of the Medicare program. There are no official Medicare cards specifically designed to track spending. Information about Medicare costs and payments is typically found on statements or online portals provided by Medicare.

Purpose and Function of Medicare Spending Tools

Medicare beneficiaries often utilize various tools to manage their healthcare costs associated with Medicare coverage. These tools might include online portals, benefit summaries, and statements from healthcare providers. These resources provide details on the services covered, co-pays, and overall out-of-pocket expenses.

Types of Medicare Spending Cards (or Alternatives)

As previously mentioned, there are no official Medicare spending cards. Instead, beneficiaries rely on different methods for monitoring their spending, as Artikeld in the previous section.

How Medicare Spending Tools Work

Medicare spending tools operate by providing detailed information about Medicare-covered services. This data allows beneficiaries to monitor their spending, track their remaining out-of-pocket maximums, and understand their coverage limits. Medicare’s online portals and statements are regularly updated, ensuring accurate information on expenses.

Examples of When Medicare Spending Tools Are Useful

Medicare spending tools are helpful in several scenarios. Beneficiaries can use them to monitor their expenses and plan for upcoming healthcare costs. Tracking out-of-pocket expenses helps beneficiaries understand their financial responsibilities under Medicare. These tools can also be used to anticipate costs associated with specific medical procedures or treatments.

Comparison of Medicare Spending Card Options (Hypothetical)

| Feature | Option A (Hypothetical) | Option B (Hypothetical) | Option C (Hypothetical) |

|---|---|---|---|

| Cost | Free (integrated into Medicare account) | Subscription fee (monthly or annual) | Included in premium (as part of Medicare Advantage plan) |

| Benefits | Real-time tracking of payments, personalized cost estimates | Personalized spending reports, detailed cost analysis | Cost breakdowns of Medicare-covered services, projected out-of-pocket expenses |

| Eligibility | All Medicare beneficiaries | Medicare beneficiaries with specific healthcare plans | Beneficiaries enrolled in Medicare Advantage plans |

Note: The table above presents hypothetical options. Actual Medicare spending tools may vary significantly.

Authenticity and Legitimacy Concerns

Medicare spending cards, while helpful tools, can be targets for fraudulent activities. Understanding potential red flags and the proper verification procedures is crucial for consumers to protect themselves from scams and ensure the accuracy of their information. This section Artikels the common pitfalls and steps to take when encountering suspicious spending cards.

Red Flags Indicating Fraud

Knowing the signs of a fraudulent Medicare spending card is vital for preventing financial harm. A card with inconsistent formatting, missing or illegible information, or a suspiciously low spending amount are potential red flags. The presence of unusual or overly detailed information, such as personalized anecdotes or promises of large refunds, should also raise suspicion. Contacting Medicare directly to confirm the validity of a card is always advisable.

Determining if a Medicare spending card is legitimate can be tricky. Contacting State Farm directly is crucial for verifying claims, and you can find their claims phone number here. Ultimately, researching the issuer and reviewing any documentation is essential to ensure the card’s authenticity.

If the information provided doesn’t align with known details of the recipient, it’s essential to scrutinize further.

Potential Medicare Spending Card Scams

Various scams target Medicare beneficiaries. One common tactic involves impersonating Medicare representatives and requesting personal information under the guise of verification. These fraudulent calls often pressure recipients into providing sensitive data. Phishing scams, which send emails or text messages claiming to be from Medicare, requesting personal information or login credentials, are also prevalent. Beware of unsolicited offers of unusually low premiums or large refunds.

Such promises often indicate fraudulent activity.

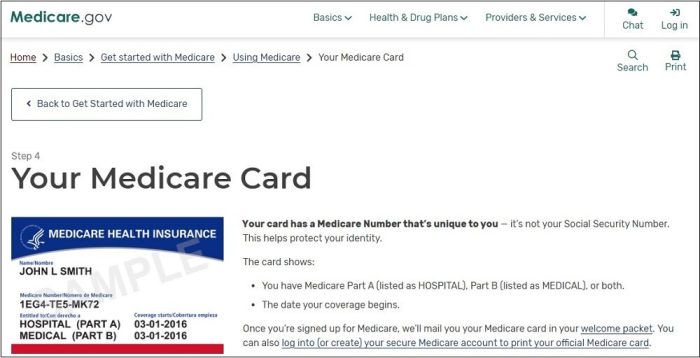

Verifying the Legitimacy of a Medicare Spending Card

The process for verifying a Medicare spending card’s legitimacy is straightforward. First, review the card for inconsistencies in formatting or printing. Verify the card’s details against official Medicare records. Comparing the card’s information with other official documents, like your Social Security card or Medicare Summary, can help ensure accuracy. Always contact Medicare directly if there’s any uncertainty about the card’s authenticity.

The Medicare website provides a dedicated section on verifying card legitimacy.

Reporting Suspected Fraud

If you suspect Medicare fraud, reporting it is essential to protect yourself and others. Report the suspected fraud to the Medicare hotline or use the online reporting tools available on the official Medicare website. Documentation, including copies of the suspicious card and any related correspondence, should be retained. Providing detailed information about the fraudulent activity, including dates, times, and contact information of any involved parties, can aid in the investigation.

Steps to Take if You Suspect Fraud

| Step | Description |

|---|---|

| 1 | Immediately stop any further interaction with the suspected fraudulent party. |

| 2 | Contact Medicare directly to verify the legitimacy of the spending card. |

| 3 | Report the suspected fraud to the Medicare fraud hotline or use the online reporting tools on the Medicare website. Provide all relevant details, including any communication or documentation related to the incident. |

Comparing with Other Options

Medicare spending cards are one potential resource for managing Medicare costs, but they’re not the only option. Understanding other financial assistance programs can help individuals make informed decisions about which best aligns with their specific needs and circumstances. This section explores alternative programs, highlighting their strengths and weaknesses to provide a comprehensive view.

Comparison with Other Financial Assistance Programs

Various government and non-profit programs offer financial assistance for Medicare expenses. These options often differ in eligibility criteria, cost-sharing responsibilities, and the types of services they cover. Carefully evaluating these alternatives is crucial for maximizing benefits and minimizing out-of-pocket costs.

Eligibility Criteria

The eligibility criteria for each financial assistance program vary significantly. Some programs might focus on low-income individuals, while others prioritize those with specific medical conditions or disabilities. The specific requirements for each program are crucial to determine if an individual qualifies. For example, the eligibility criteria for Medicaid often include income limitations and resource tests, while the eligibility criteria for the Low-Income Subsidy may vary by state.

These requirements are often publicly available on the respective program’s website.

Cost-Sharing Responsibilities

Cost-sharing responsibilities differ greatly between various financial assistance programs. Some programs might cover a larger portion of Medicare expenses, while others might only provide limited support. Understanding the level of cost-sharing for each option is essential in determining the financial burden on the individual. This is important in understanding the total cost, including any out-of-pocket expenses not covered by the program.

Benefits and Coverage

The benefits and coverage offered by different programs vary significantly. Some programs may cover a broader range of Medicare-related expenses, including premiums, deductibles, and co-pays, while others may be more limited in scope. The specific benefits offered should be carefully evaluated in relation to the individual’s specific healthcare needs. For instance, some programs might provide coverage for prescription drugs, while others may not.

Determining the Best Option, Is the medicare spending card legit

The best financial assistance program for an individual will depend on their unique circumstances. Factors to consider include income, health status, and the specific Medicare expenses they anticipate. Individuals should carefully review the eligibility criteria, cost-sharing responsibilities, and benefits offered by each program to determine the best fit. For instance, a senior with a high income and relatively low medical expenses might find the Medicare spending card less advantageous compared to a low-income individual requiring extensive medical care.

Table: Key Differences

| Feature | Medicare Spending Card | Option A (e.g., Medicaid) | Option B (e.g., Low-Income Subsidy) |

|---|---|---|---|

| Eligibility Criteria | Generally based on income and assets. | Generally based on income and resources. | Generally based on income, sometimes with specific requirements. |

| Cost | Potentially reduced cost-sharing. | Often covers significant portions of Medicare expenses. | May provide assistance with premiums and cost-sharing. |

| Benefits | Focus on reducing out-of-pocket expenses. | Comprehensive coverage of Medicare expenses, potentially including additional benefits. | May cover a portion of premiums or cost-sharing. |

Practical Implications and Considerations

Medicare spending cards, when legitimate, can provide a convenient way to track and manage healthcare costs. However, understanding their limitations and the responsibilities involved is crucial for effective use. This section delves into practical applications, potential pitfalls, and the role of insurance companies in the process.Effective use of a Medicare spending card hinges on a thorough grasp of its functionalities and limitations.

Understanding the terms and conditions is paramount, as it dictates how the card operates and what it covers. Misinterpretations can lead to financial difficulties or missed opportunities for cost savings.

While the legitimacy of Medicare spending cards is a crucial question, understanding the Fremont House of Pizza menu is equally important for planning a satisfying meal. To confirm the validity of your Medicare spending card, consult official government resources. Reviewing the Fremont House of Pizza menu can help you budget your meal for the evening. Ultimately, ensuring your Medicare spending card is genuine is paramount.

Utilizing a Medicare Spending Card Effectively

Medicare spending cards, when properly used, can be a valuable tool for monitoring healthcare expenses. They typically function as a record of payments made and services received. Carefully review the card’s details to understand how it records these transactions.

- Record Keeping: A key aspect of using the card effectively is meticulous record-keeping. This involves documenting all transactions, including dates, amounts, and service descriptions. This detailed record can assist in understanding and tracking expenses.

- Comparison with Estimates: Regularly compare the recorded expenses on the card with your anticipated or estimated costs. This proactive approach can help identify any discrepancies or unexpected charges.

- Reconciliation with Statements: The card should be reconciled with your official Medicare statements. Discrepancies should be promptly addressed with the provider or insurance company.

Potential Limitations and Drawbacks

While a Medicare spending card can be beneficial, it’s essential to be aware of its potential limitations. These limitations might restrict its applicability in certain situations.

- Limited Coverage: The coverage offered by a Medicare spending card may not encompass all aspects of healthcare costs. It is crucial to verify the card’s terms and conditions to understand the scope of its coverage.

- Potential for Errors: Like any record-keeping system, errors can occur. It’s essential to double-check entries and promptly correct any inaccuracies to maintain the card’s accuracy.

- Incompleteness of Information: The card might not capture all expenses, particularly those that are not directly billed through the card. This requires supplementing the card’s information with other records for a complete picture.

Importance of Understanding Terms and Conditions

Comprehending the terms and conditions of a Medicare spending card is critical for effective utilization. These conditions Artikel the card’s scope, responsibilities, and potential limitations.

- Specific Procedures: The terms and conditions will detail the procedures for submitting claims, disputing charges, and obtaining reimbursements. Review these guidelines thoroughly.

- Exclusions: Identify any services or expenses that are excluded from the card’s coverage. This proactive approach helps avoid misunderstandings.

- Dispute Resolution: Understand the process for resolving disputes or disagreements regarding charges or reimbursements. The terms should clearly Artikel the steps for resolution.

Role of the Insurance Company

The insurance company plays a vital role in the Medicare spending card process. Their involvement is often critical for handling claims and providing support.

- Claim Processing: Insurance companies handle the processing of claims submitted using the spending card. Their efficiency affects the speed and accuracy of reimbursement.

- Customer Support: The insurance company provides support for users of the spending card. This support can address issues or questions about the card’s use.

- Policy Clarification: The insurance company is instrumental in clarifying policies related to the card’s use, helping users understand the coverage scope.

Step-by-Step Guide for Using a Medicare Spending Card

A step-by-step guide to using a Medicare spending card is Artikeld below:

- Review Terms: Carefully review the terms and conditions of the spending card to understand its limitations and coverage.

- Record Transactions: Document each transaction, including the date, amount, and description of the service.

- Compare with Estimates: Compare the recorded expenses with estimated costs to identify potential discrepancies.

- Reconcile with Statements: Reconcile the card’s records with official Medicare statements to ensure accuracy.

- Contact Support: Contact the insurance company or provider for clarification on any uncertainties.

- Dispute Resolution: Follow the dispute resolution process if necessary, as Artikeld in the card’s terms.

Example Transactions:

| Date | Description | Amount |

|---|---|---|

| 2024-03-15 | Doctor Visit | $150 |

| 2024-03-20 | Prescription Drugs | $75 |

| 2024-03-25 | Hospitalization | $2,500 |

Specific Examples and Case Studies

Medicare spending cards, while potentially helpful, are not a one-size-fits-all solution. Understanding when they are appropriate and how they affect costs is crucial for informed decision-making. This section presents scenarios illustrating their potential benefits and drawbacks.

A Helpful Scenario

A retired couple, the Smiths, have a fixed income and are enrolled in Medicare. They have a chronic condition requiring regular doctor visits and specialized medication. Using a Medicare spending card, they track their out-of-pocket healthcare expenses, identifying areas where they could potentially reduce costs. The card’s ability to categorize expenses and display projected spending helped them plan for upcoming medical needs, such as a planned surgery, and allowed them to negotiate better prices with providers.

This proactive approach allowed them to maintain a budget for essential living expenses while still ensuring timely and necessary medical care.

An Inappropriate Scenario

A young, healthy individual with a standard Medicare plan may not find a Medicare spending card particularly beneficial. Their healthcare needs are limited, and their out-of-pocket expenses are likely manageable without additional tracking. The effort of using the card may not outweigh the benefits in this case.

Impact on Healthcare Costs

Medicare spending cards can affect healthcare costs in several ways. By providing a clear picture of out-of-pocket expenses, individuals can make informed choices about care and negotiate better prices with providers. This transparency can potentially lead to lower costs overall. Conversely, if the card’s use leads to unnecessary stress or anxiety about healthcare expenses, it could indirectly affect the quality of care received.

A lack of proper understanding of the card’s features might lead to increased costs due to delayed or avoided necessary medical treatments.

Fictional Case Study: The Jones Family

The Jones family consists of a retired couple, Mr. and Mrs. Jones, enrolled in Medicare, and their adult child, Sarah, who is also covered by Medicare. Mr. Jones requires regular physical therapy sessions.

Mrs. Jones needs routine checkups with her physician. Sarah has ongoing mental health needs. By using a Medicare spending card, the Jones family can monitor their combined healthcare expenses. The card helped them identify patterns in their spending and anticipate future needs.

For example, they realized their physical therapy costs were higher than expected and sought alternative, more affordable options. The family was able to use the spending card to track and manage their Medicare expenses effectively.

Potential Problems

Using a Medicare spending card may present challenges. Misinterpreting the card’s information could lead to incorrect assumptions about future costs. Additionally, the card might not cover all out-of-pocket expenses, potentially leaving gaps in coverage. Lack of familiarity with the card’s functionalities and limitations can cause difficulties in utilizing its features effectively. Furthermore, the card’s accuracy depends on the provider’s data reporting, and inaccurate data could lead to an inaccurate picture of spending.

Finally, the card may not be suitable for everyone due to varying healthcare needs and financial situations.

Ending Remarks

So, is the Medicare spending card legit? The answer isn’t a simple yes or no. It depends on your specific circumstances, and whether you’re looking at the right option for your needs. Weighing the potential pros and cons, and understanding the terms and conditions, is crucial. Thorough research and critical thinking are essential before making any decisions.

Ultimately, you’re in control of your health decisions, and this guide aims to arm you with the knowledge to navigate this complex area effectively.

FAQ Explained

Is there a fee for using the Medicare spending card?

Fees vary. Some cards might have transaction fees or annual fees. Check the terms and conditions for specifics.

What are the eligibility requirements for a Medicare spending card?

Eligibility criteria will differ based on the specific card. Some cards might require you to be enrolled in Medicare, while others may have additional income requirements. Check the fine print!

How can I report suspected fraud related to a Medicare spending card?

Contact the card issuer directly and report your concerns. Also, report the incident to the relevant authorities.

What are the potential limitations of using a Medicare spending card?

The spending card might not cover all of your medical expenses. Also, some providers may not accept it, or there might be limitations on the types of services it covers.