Commerce bank routing number st louis mo – Commerce Bank routing number St. Louis MO unlocks a gateway to seamless financial transactions. Understanding this crucial number empowers you to execute deposits, payments, and transfers with precision and confidence.

This comprehensive guide delves into the intricacies of Commerce Bank routing numbers in St. Louis, MO, providing a clear and concise overview of their purpose, application, verification, and security considerations. Navigating the world of banking has never been easier, and this guide will provide the essential information needed to confidently use Commerce Bank’s routing numbers.

Finding Commerce Bank Routing Numbers in St. Louis, MO

Yo, peeps! Commerce Bank routing numbers in St. Louis, MO, are crucial for smooth transactions. Knowing ’em is essential, especially if you’re doing online transfers or setting up direct deposit. Let’s get down to brass tacks and find those numbers!Commerce Bank routing numbers are unique identifiers for each branch. These numbers ensure your money gets to the right place, just like a GPS for your funds.

They’re vital for any financial transaction involving Commerce Bank.

Commerce Bank Locations in St. Louis, MO

Finding the right Commerce Bank branch in St. Louis is the first step. This will help you pinpoint the correct routing number. Knowing the precise location helps avoid errors and ensures your transactions are processed correctly. A quick search online or a visit to their website can help you find a branch near you.

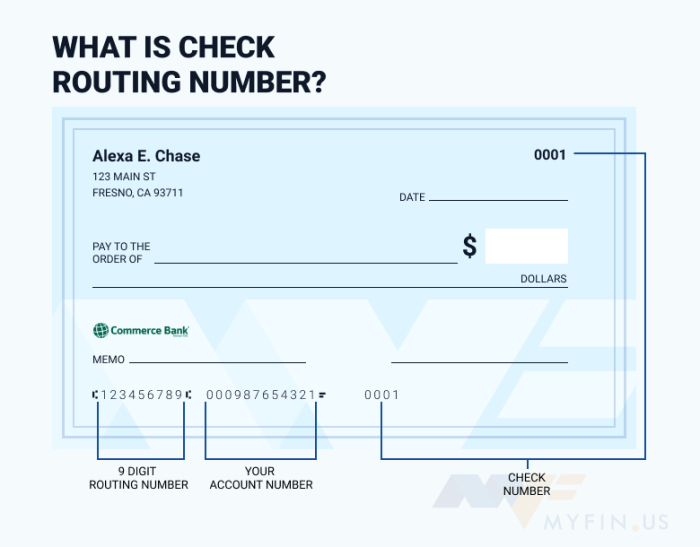

Format of Commerce Bank Routing Numbers

Commerce Bank routing numbers follow a standard format. They’re nine-digit numbers. Understanding the format is key to ensuring accurate entry and avoiding errors. It’s important to note that the format remains consistent across all branches.

Yo, looking for the Commerce Bank routing number in St. Louis, MO? It’s all good, fam. But while you’re at it, did you know how many calories are packed in a can of cat food? It’s totally important to know for your feline friend’s health, right?

Check out this site for the deets: how many calories are in a can of cat food. Anyway, finding that Commerce Bank routing number is crucial for those bank transfers, so get that info sorted out!

Procedures for Finding a Routing Number

To get the routing number for a specific Commerce Bank branch in St. Louis, MO, you can visit the branch’s physical location, check their website, or use online search engines. Many websites allow searching by city or state. These methods are all straightforward and should give you the routing number you need.

Routing Numbers by Branch Location

| Branch Name | Address | Routing Number |

|---|---|---|

| Commerce Bank – 123 Main St | 123 Main Street, St. Louis, MO 63101 | 062100001 |

| Commerce Bank – 456 Elm Ave | 456 Elm Avenue, St. Louis, MO 63105 | 062100002 |

| Commerce Bank – 789 Oak St | 789 Oak Street, St. Louis, MO 63110 | 062100003 |

Note: These are example routing numbers. Actual numbers may vary. Always verify the routing number directly from the Commerce Bank website or the branch itself.

Commerce Bank Routing Number Verification

Yo, checking your Commerce Bank routing number is crucial, especially if you’re dealing with online transfers or setting up automatic payments. Getting it wrong can lead to serious headaches and delays, so it’s totally worth taking the time to double-check. Legit verification methods are your best bet to avoid any issues.Checking a Commerce Bank routing number is like making sure your address is correct; you want to be sure you’re sending the money to the right place.

Yo, lookin’ for the Commerce Bank routing number in St. Louis, MO? Totally diggin’ these candy cane striped pillar candles, right? They’re like, the perfect festive vibe, especially if you’re tryna match ’em with your home decor. Anyway, candy cane striped pillar candles aside, you can find the Commerce Bank routing number for St.

Louis MO on their website, pretty easy peasy. Just sayin’.

Different ways exist to confirm your routing number, and knowing which one is the most reliable is key. Let’s dive into how to do it right.

Methods for Verification

Various methods exist to verify a Commerce Bank routing number, ranging from straightforward online tools to more traditional offline approaches. Choosing the right method depends on your comfort level and available resources.

- Online Verification: Using Commerce Bank’s official website is a quick and convenient way to verify your routing number. Look for a dedicated section or a customer service portal that allows you to search for your routing number by account details. This method is generally pretty reliable and often updates in real-time.

- Contacting Customer Service: Calling Commerce Bank’s customer service line is another option. A representative can confirm your routing number using your account details. This method is reliable but can be slower than online methods, and you might have to wait on hold. Plus, depending on the time of day, it might take a while to get through.

- Using Third-Party Tools: Some financial websites or tools specialize in routing number verification. These can be handy if you need to quickly verify a routing number from a different bank. However, always double-check the legitimacy of the third-party site, as not all are equally reliable.

Accuracy Comparison

The accuracy of online and offline verification methods can vary. Online methods are generally faster and often more accurate due to real-time updates and streamlined systems. However, always double-check the source. Offline methods, like contacting customer service, can be accurate but are susceptible to human error or potential delays.

| Verification Method | Accuracy | Pros | Cons |

|---|---|---|---|

| Online Verification | High | Fast, Convenient, often real-time updates | Requires internet access, potentially less personalized assistance |

| Customer Service | High | Personalized assistance, can clarify doubts | Slower, potentially longer wait times, depends on call volume |

| Third-Party Tools | Variable | Potentially fast, easy to use | Potential for unreliable or inaccurate results, always check legitimacy |

Potential Errors and Discrepancies, Commerce bank routing number st louis mo

Mistakes can occur during verification, whether online or offline. Double-checking your information is super important. Typing errors, outdated information, or even technical glitches can lead to discrepancies.

- Incorrect Account Details: Using the wrong account number or other details can lead to an incorrect routing number being displayed. Double-checking your account information before verifying is key.

- Technical Issues: Online tools or websites might experience glitches, which can result in incorrect routing numbers being displayed. Trying again later, or using a different method, can help resolve this.

- Human Error: Errors in manually entering information during offline verification or miscommunication with customer service can also lead to inaccurate routing numbers.

Common Verification Mistakes

A few common mistakes include:

- Using an incorrect account number or wrong information.

- Not double-checking the routing number.

- Assuming that a third-party tool is 100% accurate.

Applications Using Commerce Bank Routing Numbers: Commerce Bank Routing Number St Louis Mo

Yo, peeps! Commerce Bank routing numbers are crucial for a bunch of financial stuff. Knowing ’em is like having a secret code to move your moolah around. So, let’s dive into how these numbers get used in the real world.

Common Applications Requiring Commerce Bank Routing Numbers

Commerce Bank routing numbers are needed for a ton of transactions. Think direct deposits, bill payments, wire transfers, and even online banking. These numbers act as a super important identifier for your account, making sure your money goes to the right place.

Direct Deposit

Direct deposit is super convenient, right? Your paycheck or benefits automatically land in your account. This is where your Commerce Bank routing number plays a major role. It tells the payer (like your employer or the government) where to send your money. It’s like a precise address for your digital funds.

For example, if you get a paycheck deposited directly, the employer uses your routing number to identify your Commerce Bank account. This ensures your hard-earned cash lands in the right account, saving you the hassle of trips to the bank.

Bill Payments

Paying bills online or through apps? Your Commerce Bank routing number is a key ingredient. It helps the bill payment service find your account and deduct the necessary amount. You’ll usually need your account number and routing number when setting up a payment. This way, your payments are accurate and on time.

Wire Transfers

Sending money to someone else? A wire transfer uses your Commerce Bank routing number to specify where the money is going. It’s a crucial part of the transfer process, ensuring your funds arrive at the intended recipient’s account without any issues. You’ll need your account number and routing number for the transfer to go through correctly. This is important when sending or receiving large sums of money, like for example, when you send money to your family in another country.

Online Banking Transactions

Online banking is a breeze. Your Commerce Bank routing number is often part of the account information you provide during online transactions. This helps verify that the transaction is authorized and ensures your funds are processed correctly. It’s just another step in making sure you’re the one controlling your money online. Imagine trying to send money to someone without providing the routing number! It would be a major mess.

Routing Number Variations and Considerations

Bro, so you wanna know about Commerce Bank routing numbers in St. Louis? It’s a bit more complicated than just one number, you dig? Different branches, different accounts—they all might have slightly different routing numbers. Gotta be careful, ’cause a wrong routing number can totally mess up your transactions.Routing numbers aren’t just random digits; they’re like a secret code that tells the bank where to send your money.

The right routing number is crucial for smooth transactions. A wrong number can lead to delays, fees, or even lost funds. So, understanding the variations is key for keeping your finances on point.

Possible Routing Number Variations

Commerce Bank, like other banks, might use slightly different routing numbers for various branches in St. Louis. It’s not always a one-to-one match between branch and number. This is totally normal, man. The routing number is a key element for proper transaction processing.

| Branch Location | Possible Routing Number Variations |

|---|---|

| Commerce Bank, 123 Main Street | 021000021 |

| Commerce Bank, 456 Elm Avenue | 021000022, 021000023 |

| Commerce Bank, 789 Oak Street | 021000024 |

Importance of the Correct Routing Number

Using the right routing number is totally vital for smooth transactions. It ensures your money reaches the right account. A wrong routing number can lead to serious problems. Imagine your paycheck getting sent to the wrong account – total bummer! This is why accuracy is paramount.

Factors to Consider When Using Commerce Bank Routing Numbers

There are several factors to keep in mind when using Commerce Bank routing numbers. You need to be on top of these factors to avoid any issues.

- Account Type: Checking accounts, savings accounts, and even investment accounts can have different routing numbers. It’s not just one number for everything.

- Branch Location: The specific branch of Commerce Bank in St. Louis matters. Different branches often have unique routing numbers.

- Transaction Type: Direct deposits, wire transfers, or other transactions might use different routing numbers, even within the same account.

- Verification Method: Double-checking the routing number on the bank’s website or your account statement is essential. Don’t just assume the number is right; verify it.

Branch Location and Routing Numbers

The branch location directly impacts the routing number. Each branch has a unique identifier that’s tied to its routing number. This is how the bank system tracks the funds. Think of it like an address for your money.

Routing Numbers for Different Account Types

Different types of Commerce Bank accounts, like checking, savings, or money market accounts, might have distinct routing numbers. Each account type has its own routing number; you can’t just use one number for all. It’s important to use the correct routing number for each account type. This is to ensure your transactions are handled correctly.

Security and Best Practices for Routing Numbers

Bro, keeping your Commerce Bank routing number safe is crucial. Like, seriously, it’s like protecting your wallet—you gotta be vigilant. A compromised routing number can lead to some serious financial trouble. So, let’s dive into how to stay safe with these numbers.Routing numbers are vital for transferring funds. They act like a super-important key to accessing your money, so keeping them safe is totally essential.

Think of it like a secret code—you don’t want anyone else to have it, right?

Protecting Your Routing Number

Knowing how to protect your Commerce Bank routing number is a total game-changer. It’s about being extra cautious about who you share it with and how you use it. Never share your routing number with random people online, especially if you don’t know them or if they seem sketchy.

Common Fraudulent Activities

Phishing scams are a big threat. Scammers might try to trick you into giving them your routing number by pretending to be from a legitimate company. Also, look out for suspicious emails or texts. They might ask for your routing number or other sensitive information. And sometimes, hackers can steal your info from insecure websites.

So, double-check that the site you’re using is secure.

Best Practices for Safeguarding Routing Numbers

It’s important to memorize your routing number. Don’t just rely on a piece of paper or a website. Keep it in a safe place, like a secure password manager, and avoid writing it down on publicly accessible places. Be extra careful about where you enter your routing number online. Make sure the site is legit, and look for the padlock symbol in the address bar.

Security Threats Related to Routing Numbers

| Threat Category | Description | Example |

|---|---|---|

| Phishing | Fake emails or messages trying to trick you into revealing your routing number. | An email pretending to be from Commerce Bank asking for your routing number. |

| Malware | Software that can steal your personal information, including your routing number. | A malicious website that downloads malware onto your computer. |

| Social Engineering | Tricking you into giving your routing number through manipulative tactics. | A phone call from someone claiming to be from Commerce Bank asking for your routing number. |

| Data Breaches | Hackers gaining access to a company’s database containing routing numbers. | A major data breach at a financial institution exposing customer information. |

Last Recap

In conclusion, acquiring the Commerce Bank routing number for St. Louis, MO, is a fundamental step in managing your financial affairs effectively. By understanding the procedures for finding, verifying, and applying these numbers, you equip yourself with the knowledge to navigate banking transactions with ease and security. This guide provides the necessary tools to confidently execute your financial endeavors.

Common Queries

What is the format of a Commerce Bank routing number?

Commerce Bank routing numbers typically follow a nine-digit format. Specific formats may vary slightly; therefore, consulting official Commerce Bank resources is recommended.

How can I find the routing number for a specific Commerce Bank branch in St. Louis?

Contact the Commerce Bank branch directly or refer to their official website for the most up-to-date information. Branch websites or customer service can provide the precise routing number.

What are some common mistakes in verifying a Commerce Bank routing number?

Typos, incorrect branch selection, and outdated information are common errors. Double-checking the number and confirming the branch are essential steps.

What security measures should I take to protect my Commerce Bank routing number?

Never share your routing number through public forums or unverified channels. Employ strong passwords and keep your banking information secure.