Sample letter of bank account closure: Navigating the process of closing your bank account can feel daunting. But don’t worry, this comprehensive guide simplifies the procedure, providing you with the knowledge and resources you need to initiate the closure smoothly and efficiently. From understanding the necessary documents to choosing the best closure method, we’ll cover every crucial aspect of the process.

This guide will walk you through the various steps involved, from understanding account closure to creating a compelling letter. We will also delve into the implications of different scenarios, such as closing a joint account or one with outstanding balances. Learn about the typical timeframe for closure and the various ways to submit a closure request. Plus, we’ll provide example letters for different situations, making the process transparent and accessible.

Understanding Account Closure

Closing a bank account is a straightforward process, although specific procedures may vary slightly between institutions. This process involves a series of steps designed to ensure the account is properly terminated and all outstanding balances are settled. Understanding these steps is crucial for a smooth transition and avoids potential complications.

Account Closure Process

The process of closing a bank account typically involves initiating a request, verifying the account holder’s identity, settling any outstanding balances, and returning any associated cards or physical documents. Specific procedures can differ between banks. Account closure is a formal process requiring the account holder’s active participation.

Reasons for Account Closure

Individuals close bank accounts for a variety of reasons. Common reasons include relocating to a new area, dissatisfaction with services, or a desire to consolidate accounts. Financial institutions may also initiate closure due to inactivity or suspected fraudulent activity. Furthermore, individuals might choose to close an account as part of a larger financial reorganization strategy.

Types of Accounts Subject to Closure

Bank accounts come in various forms, each subject to closure procedures. These include checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). The process for closing each account type is generally similar but may involve unique considerations based on the account’s specific features and terms.

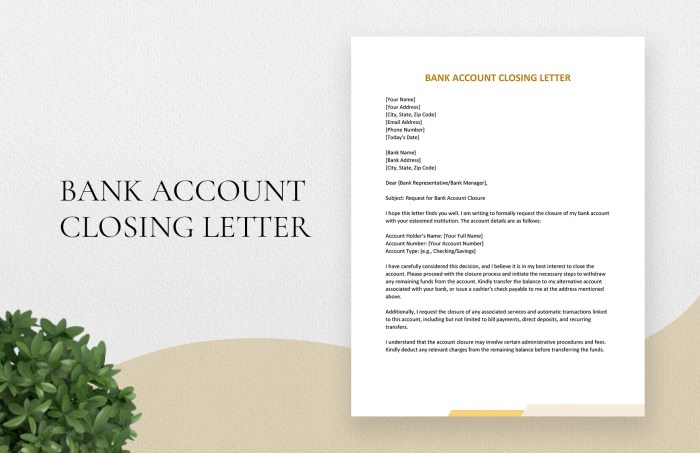

Initiating a Closure Request, Sample letter of bank account closure

To initiate the closure process, the account holder typically contacts the bank directly. This can be done through phone calls, online banking portals, or in-person visits to a branch. The bank will require verification of the account holder’s identity to prevent unauthorized closures. This may include providing identification documents like a driver’s license or passport.

Steps in Account Closure

- Contact the bank: The account holder should contact the bank using the preferred method (phone, online, in-person). Provide account details, including account number and full name.

- Account verification: The bank will request verification of the account holder’s identity. This might involve providing a copy of a government-issued ID.

- Balance confirmation: The bank will confirm the current balance and any outstanding transactions. Any outstanding debts or fees must be settled before closure.

- Closure confirmation: The bank will confirm the account closure and notify the account holder about the final date of closure.

- Return of items: The bank will return any physical cards or documents associated with the account, if applicable.

Account Closure Flowchart

Required Documentation

Proper account closure necessitates the submission of specific documentation to verify the account holder’s identity and the legitimacy of the closure request. This ensures the bank safeguards its assets and complies with regulatory requirements. Accurate and complete documentation is crucial for a smooth and efficient closure process.The documentation requirements for closing a bank account vary depending on the specific bank and its internal policies.

While the fundamental documents remain similar across institutions, specific formats and supporting materials might differ. Therefore, it is essential to consult the bank’s official guidelines or contact their customer service representatives for precise requirements.

Identification Documents

Verification of the account holder’s identity is paramount. This typically involves presenting valid government-issued photo identification. Examples include passports, driver’s licenses, and national identity cards. These documents serve as proof of the account holder’s legal status and connection to the account. The specific photo ID required might vary based on the country of the bank and the account holder.

Proof of Address

Demonstrating the account holder’s current address is equally important. This can be achieved through utility bills (electricity, water, gas), lease agreements, or bank statements. The documents should be recent and reflect the account holder’s current residential address.

Account Closure Request Form

A formal request for account closure is necessary to initiate the process. The form is typically provided by the bank and requires specific information, including account number, reason for closure, and desired closure date. Completing the form accurately is crucial for smooth processing.

Supporting Documents

Occasionally, additional supporting documents might be required. These could include proof of payment for any outstanding charges, confirmation of a beneficiary for funds transfer (if applicable), or a letter of authorization if the account is closed for a representative.

Comparison of Bank Documentation Requirements

Different banks may have slight variations in their documentation requirements. Some might prioritize certain documents over others, or require additional supporting materials. For example, a bank might necessitate a specific format for address verification, while another might accept multiple utility bills as proof.

Table of Necessary Documents

| Document Type | Description | Importance | Example |

|---|---|---|---|

| Account Holder ID | Proof of identity | Verification of account holder | Passport, Driver’s License, National ID Card |

| Proof of Address | Verification of current address | Establishing account holder’s current location | Utility bills, Lease Agreement, Recent Bank Statement |

| Account Closure Request Form | Formal request for account closure | Initiating the closure process | Bank-provided form |

| Supporting Documents | Additional documents as needed | Completing the closure process | Proof of payment, Beneficiary information, Authorization letter |

Account Closure Process: Sample Letter Of Bank Account Closure

The process for closing a bank account varies slightly depending on the chosen method and the bank’s specific procedures. Thorough understanding of the steps involved ensures a smooth and efficient closure process, minimizing potential delays or complications. Adherence to the bank’s guidelines and timely submission of required documents are crucial for successful account closure.

Typical Timeline for Account Closure

The timeframe for closing a bank account is contingent upon several factors. These include the chosen closure method, the completeness of the submitted documentation, and any internal bank procedures. While some closures can be finalized within a few business days, others might take a week or more. Factors such as holidays or high account volume can also affect the timeline.

So, you’re looking for a sample letter to close your bank account? It’s a pretty straightforward process, really. Just remember to include all the necessary details. Oh, and while you’re at it, did you know how much gym insurance typically costs? You might want to check out how much is gym insurance for some info on that.

Basically, you’ll need to clearly state your intention to close the account and provide the necessary documentation. Then, bam! Account closure complete!

For instance, a customer closing an account online during a quiet period might see the closure finalized within a day, while a customer closing a large account in person during peak season might experience a delay.

Methods for Submitting a Closure Request

Banks offer multiple channels for initiating account closure requests. These methods include online portals, in-person visits to branches, and mail. The choice of method often depends on the customer’s convenience and the bank’s accessibility.

Closing an Account Online

The online account closure process typically involves accessing the bank’s online banking platform. Instructions for initiating the closure are usually available within the platform’s interface. Customers typically need to complete an online form detailing their intent to close the account. This form usually requires the customer to confirm their account details, provide a reason for closure, and specify if they wish to have any funds transferred to another account.

Successfully completing and submitting this form usually initiates the closure process.

Closing an Account in Person

Closing an account in person requires a visit to the bank’s branch. Customers must bring the required documentation, such as their valid identification and account statements. A representative at the branch will guide the customer through the process, verify the documentation, and confirm the account closure request. The representative will also inform the customer about the expected timeline for the closure.

Often, a signature is required on the appropriate forms.

Closing an Account via Mail

Closing an account via mail typically involves sending the required documents, such as a completed account closure form, a copy of identification, and the account statement, to the bank’s designated address. Banks usually provide specific instructions on the type of documentation required and the mailing address. Customers should carefully follow the instructions provided by the bank, ensuring all documents are clearly labeled and sent via certified mail to enhance tracking.

This method may take longer than online or in-person closure requests due to the postal process.

Summary Table of Closure Methods

| Closure Method | Procedure | Timeline |

|---|---|---|

| Online | Access online banking platform, follow steps Artikeld on the platform. | Variable, typically quick, often within 1-3 business days. |

| In-Person | Visit branch, submit required documents, complete forms, and receive confirmation. | Variable, may take 1-5 business days, depending on branch operations and account complexity. |

| Send documents by mail, following bank’s instructions for mailing. | Variable, may take 7-14 business days, potentially longer, depending on postal delays and bank processing. |

Important Considerations

Closing a bank account involves careful consideration of various factors. Understanding the implications of different account types and circumstances is crucial to avoid potential issues or unexpected charges. This section details important considerations for various scenarios.

Implications of Closing a Joint Account

Joint accounts require the agreement of all account holders for closure. Failure to obtain the consent of all parties may result in complications or delays in the account closure process. For example, if one joint account holder refuses to cooperate, the account cannot be closed until their agreement is obtained. This situation necessitates communication and negotiation between all parties involved.

Furthermore, the closure process may differ based on the terms of the joint account agreement.

Need a sample letter for closing your bank account? It’s a pretty straightforward process, but you might want to check out some online resources for templates. Speaking of straightforward, have you tried making chicken shawarma in a loaf pan? This recipe looks pretty simple, and the whole meal might be even easier than writing that closure letter! Either way, a well-crafted letter is key to a smooth account closure.

Implications of Closing an Account with Outstanding Balances or Transactions

Closing an account with outstanding balances or active transactions requires careful attention to ensure all obligations are fulfilled. Unresolved transactions, such as pending payments or outstanding debts, may lead to continued charges or unresolved account issues. It is crucial to ensure all transactions are completed before initiating the closure process. This might involve contacting the bank to settle outstanding balances or clearing any pending transactions.

Process for Closing an Account with Insufficient Funds

Accounts with insufficient funds may face challenges in closure. The bank may require the account holder to deposit sufficient funds to cover any outstanding fees or charges before the account can be closed. If the account holder is unable to resolve the insufficient funds issue, the bank may follow established procedures to handle such situations. For instance, the bank might apply any available funds to cover outstanding fees or charges, potentially leading to further action if the issue remains unresolved.

Closing an Account for a Deceased Person

Closing an account for a deceased person necessitates providing the bank with the required documentation, such as a certified copy of the death certificate. The bank’s procedures for handling such situations will vary depending on the specific requirements and regulations. For example, the bank may require the executor or legal representative of the deceased to initiate the closure process.

This process typically involves providing proper legal documentation to authenticate the representative’s authority.

Bank Policies Regarding Account Closure

Banks typically have specific policies governing account closure. These policies may Artikel the required documentation, procedures, and potential fees associated with the process. Reviewing the bank’s account closure policy ensures the account holder is aware of all applicable terms and conditions. The bank’s policy document, accessible on their website or within the account statements, provides the full details on their account closure practices.

Ultimate Conclusion

In conclusion, closing a bank account doesn’t have to be a stressful experience. This guide equips you with the knowledge and tools to navigate the process with confidence. By understanding the required documentation, choosing the right closure method, and utilizing the provided sample letters, you can efficiently and effectively close your account. Remember to carefully review the specific requirements of your bank, and always prioritize clear communication to ensure a smooth transition.

Ultimately, this guide empowers you to manage your financial affairs with ease and efficiency.

Expert Answers

What if I need to close my account urgently?

While banks strive to process requests efficiently, urgency might affect the timeline. Contact your bank directly to inquire about expedited closure options, if available.

Can I close an account with pending transactions?

Closing an account with pending transactions is possible, but it might involve settling those transactions first. Contact your bank for the specific procedures.

What happens to my account balance after closure?

Your final balance will be processed according to your bank’s policies. Be sure to review your account statement for confirmation.

How do I close a joint account?

Closing a joint account requires both parties’ consent and cooperation. Ensure both account holders are aware of the closure and the necessary documentation.